The New Silk Road creates markets and jobs wherever it passes, representing China’s response to the demand for development in any number of countries. The challenge for Beijing remains how to expand and prosper without appearing to threaten other world powers, especially Washington.

In just thirty years, with a growth model based on its comparative advantages and heavy in investment and exports, China has developed from a poor agricultural country to a global manufacturing powerhouse. In 2010, it officially became the world’s second-largest economy. Since the 2008 global financial crisis, however, China—along with many other countries— has been faced with economic slowdowns. Beijing has thus been searching for new ways to stimulate or sustain growth. Indeed, in a post-Trump and post-Brexit world where the USA and the UK are both retreating genuinely or symbolically from their commitment to globalization, many have expected China to play a larger role in the world economy. China’s economy now stands at some 12 trillion dollars in magnitude, contributing about one third to world economic growth in recent years.

Viewed in this context, the Belt and Road Initiative (BRI) can be taken as China’s response to a global challenge. On the one hand, China itself has to deal with industrial overcapacity such as in steel, aluminium, cement, chemicals, ship-building and construction. On the other hand, many other developing countries are experiencing rapidly rising demand—especially in infrastructure—but with a huge gap in financing and industrial capacity. Infrastructure development in Asia and the Pacific will exceed 22.6 trillion dollars through 2030, or 1.5 trillion per year. The estimate rises to more than 26 total, or 1.7 per year when costs for climate change adaption and mitigation are included.

Not surprisingly, Chinese Foreign Minister Wang Yi (in a press conference with foreign and Chinese journalists in 2016) billed the BRI as “both a major step in China’s all-round reform and opening-up under new historical circumstances, and a most important public good that China contributes to Eurasia.” He was somewhat echoed by UN Secretary-General Antonio Guterres in July of 2017: “while the Belt and Road Initiative and the 2030 Agenda are different in their nature and scope, both have sustainable development as the overarching objective. Both strive to create opportunities, global public goods and win-win cooperation.”

On the one hand, China itself has to deal with industrial overcapacity.

The Beginnings of a New Concept

The Chinese Yidai yilu changyi—translated as BRI,1 is an abbreviation of two components: the “silk road economic belt” and the “twenty-first century maritime silk road”. Chinese President Xi Jinping spoke of the first during his visit to Kazakhstan in September 2013 and of the second in Indonesia one month later. Along similar lines, Chinese Premier Li Keqiang also emphasized the need to revitalize the “maritime silk road” for ASEAN countries, and to rev up growth propellers for hinterland regions at the China-ASEAN Expo in 2013.

While the name may seem somewhat awkward in English, it rolls off the tongue in Chinese. The “belt” component is overland and includes countries situated on the traditional Silk Road, through Central Asia, West Asia, the Middle East and Europe. The “road” part refers to several contiguous bodies of water—the South China Sea, the South Pacific Ocean, the Indian Ocean and the Mediterranean—which make up the ocean-going Silk Road routes that connect China with Southeast Asia, Oceania and Africa. Taken together, countries along these Silk Road routes represent almost two-thirds of the world’s population and more than one-third of the world’s wealth.

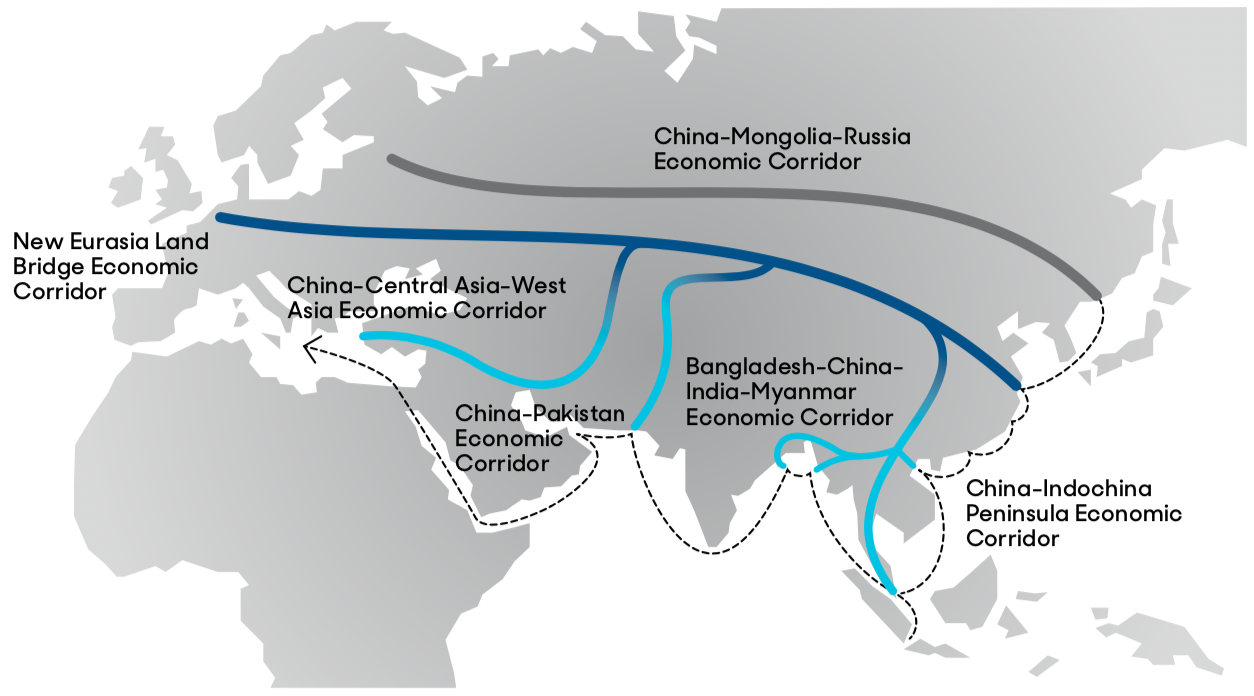

FIGURE 1: The Belt and Road initiative: six economic corridors

The appellation “silk road”, of course, is not new. Historically, the so-called Silk Road emerged as early as China’s Han Dynasty (202-220 bc). It began from China’s Chan’an (now Xi’an) in the East and ended in the Mediterranean in the West. As silk was China’s chief trade product then, Ferdinand Von Richthofen, a German geologist, coined the term Die Seidenstrasse (the Silk Road) in the mid-1800s.

To be sure, the Silk Road was not just one road but rather a network of trading routes linking commerce and cultural ties between China, India, Persia, Arabia, Rome and more. It flourished during China’s Tang Dynasty (618-907 AD), but dwindled away in the fifteenth century, with the rise of the Ottoman Empire whose rulers opposed the West. The term “silk road” has continued, however, to stir the imagination, evoking mystery and travelers from far off lands. Indeed, many now prefer to call China’s BRI the “New Silk Road”.

What is on the Menu?

Initially, details of the BRI were patchy. They became clearer in 2015, after the Chinese government published an Action Plan entitled “Vision and actions on jointly building the silk road economic belt and twenty-first-century maritime silk road.” The document was issued jointly by the National Development and Reform Commission, the Ministry of Foreign Affairs and the Ministry of Commerce, with the State Council’s authorization: an indication of extensive intragovernmental consultation and coordination.2

As envisioned by the Action Plan, the BRI is an ambitious economic framework aimed to enhance connectivity between China and countries along with the ancient Silk Road land and maritime routes and beyond, primarily in Asia and Europe, but also in Oceania, Africa and Latin America. The Action Plan defines connectivity as having five main areas of focus: policy coordination, infrastructure development, investment and trade facilitation, financial integration, and cultural and social exchange.

The infrastructure projects—roads, railways, air and seaports, oil and natural gas pipelines, power plants and power grids, and fiber optic lines— remain the first priority. This emphasis reflects China’s own experience over the past 40 years: yaozhifu, xianxuolu (want to get rich? build roads). Notably, the Action Plan says that these infrastructure projects are to be developed “in mutual consultation, mutual construction, and with mutual benefit”. These principles were highlighted again during the Belt and Road Forum held in Beijing in May 2017, presumably to allay international concerns or clarify misunderstandings that the BRI is China’s solo show.

Countries along these Silk Road routes represent almost two-thirds of the world’s population and more than one-third of the world’s wealth.

The core of the BRI is geographically structured with six economic corridors. Specifically, the “twenty-first-century maritime silk road” is envisioned as having two economic corridors: the China-Indochina Peninsula Economic Corridor (from China to Singapore through Vietnam, Laos, Cambodia, Thailand, Myanmar and Malaysia), and the Bangladesh-China- India-Myanmar Economic Corridor. The other four will make up the “silk road economic belt”: the New Eurasia Land Bridge (which will horizontally link China’s Jiangsu province with Rotterdam in Holland, through more than thirty countries along the way); the China-Mongolia-Russia Economic Corridor (from Northern China to Russia’s Far East); the China-Central Asia-West Asia Economic Corridor (from Western China to Turkey through Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan and Turkmenistan); and the China-Pakistan Economic Corridor.

These sweeping, lengthy routes aim to facilitate trade, investment, the flow of information, the movement of people, and the creation of local jobs and markets.

What is Going on in the Kitchen?

Initial numbers (from the Chinese ministries of Foreign Affairs and of Commerce), although incomplete, are impressive. Senior officials from 140 countries and 80 international organizations attended the Belt and Road Forum for International Cooperation in May 2017; China has signed intergovernmental agreements on BRI cooperation with 80 countries and organizations, and made over 50 billion dollars of outbound investment in BRI countries. In 2016, China’s outbound investment in BRI countries was 14.5 billion, while the inbound figure hit 7.1 billion—with a net figure of 7.4 billion representing a 17.5% increase over the previous year. Moreover, Chinese firms had set up 56 trade and economic cooperation zones in BRI countries with a total investment of 18.5 billion dollars, creating some 180,000 local jobs.

An “Insights e-Newsletter” from LehmanBrown notes that in 2015 Chinese firms signed 3,987 construction contracts in BRI countries, representing 44.1% of the value of all Chinese overseas construction projects. A June 2017 McKinsey & Company report finds that the local employment rate of Chinese firms in Africa is as high as 89%, indicating that Chinese overseas business operations are fairly inclusive.

One big item project is the Nairobi-Mombasa railway. This 471km-long railway connects Nairobi (the capital city of Kenya) with Mombasa (the largest port in East Africa). China invested 3.6 billion dollars in this project. Construction began in October 2014, and the line opened in June 2017: it created nearly 30,000 local jobs and cut cargo costs by 40%. This line is only the first section of a larger rail network designed to connect six East African countries—Kenya, Tanzania, Uganda, Rwanda, Burundi and South Sudan.

Another example is the China-Pakistan Economic Corridor, a 3,000km route all the way through the underdeveloped northern part of Pakistan. It starts in China’s hinterland city of Kashgar and ends in Gwadar, a deep-water port along the Arabian Sea, thus connecting the far northern reaches of the Silk Road Belt to the deepest southern ports of the Maritime Silk Road. China has already invested 62 billion dollars, about half of which for power projects to combat Pakistan’s energy shortage. Once the corridor is completed, a bulk of China’s oil imports from the Middle East, for instance, will no longer have to pass through the Strait of Malacca, dramatically reducing the shipping distance from 16 to 5 thousand kilometers (and, hence, transportation costs).

Dubai Hassyan Energy provides a glimpse into the nature of a project with multiple participants. With investment estimated at 3.4 billion dollars, this 2,400 MW clean coal power plant is a joint venture between Dubai Electricity and Water Authority (51%) and a Chinese consortium of Harbin Electric International and the Silk Road Fund (49%). The project aims to provide electricity to 250,000 households. The construction has also involved EDF and GE. Lenders include First Gulf Bank, Union National Bank, Standard Chartered Bank, Bank of China, the Industrial and Commercial Bank of China, the Agricultural Bank of China and the China Construction Bank.

Money Money Money

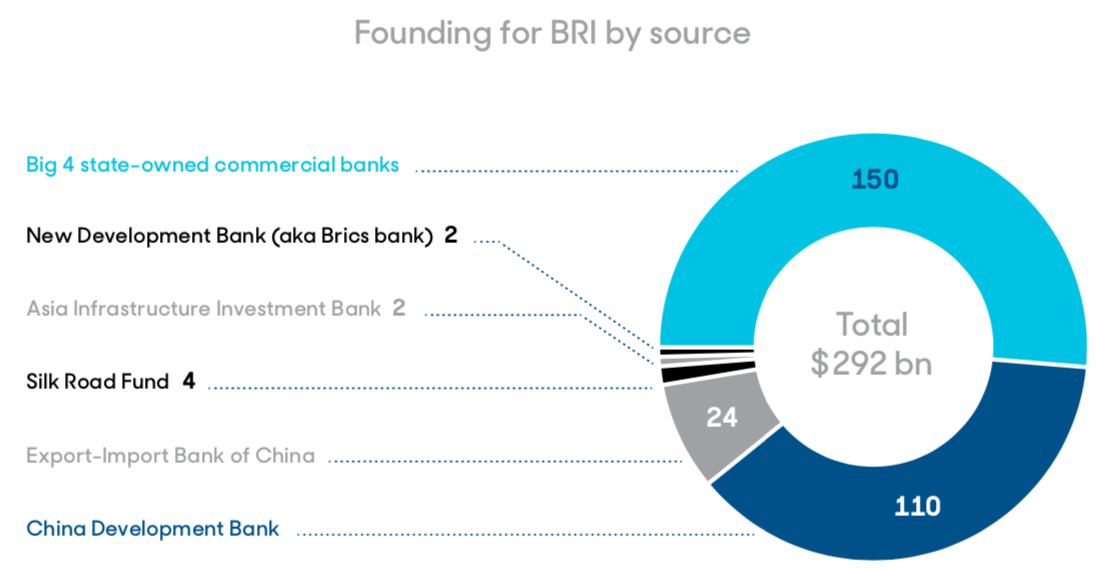

It is clear that investments will have to be massive and long-term to build BRI infrastructure projects. Presumably, many will be build-transfer-operate or build-operate-transfer schemes in which large Chinese SOES will lead the way, but smaller companies will follow.3 The Development and Reform Center (a Chinese think tank) estimates that total investment stands at 10.6 trillion dollars for the 2016-2020 period. While China seems willing to play a major role (see Figure 2), realistically, it has neither the intention nor the capacity to go it alone. Indeed, China’s deep pockets have limits, with the country’s total debt to GDP at 250%. The Action Plan states that the BRI “is open to cooperation […] with all countries, and international and regional organizations for engagement.”

FIGURE 2: figures from the end of 2016, in billions of dollars. Sources: Oxford Economics and Financial Times.

BRI implementation will require complex financial tools, including investment banking, third-party facilities, risk analysis, credit-rating and financial management. Evidence suggests that the Chinese government has encouraged blended approaches—a mixture of domestic and foreign, public and private—and the involvement of various banks and funds.

The BRI is an ambitious economic framework aimed to enhance connectivity between China and countries along with the ancient Silk Road land and maritime routes and beyond, primarily in Asia and Europe.

The Silk Road Fund, for example, is a state-owned limited liability company with a total capital of 40 billion dollars. It was established in February 2014 by four Chinese shareholders: State Administration of Foreign Exchange (65%), which manages China’s foreign currency reserves, China’s Export-Import Bank (15%), the China Development Bank (15%), and the China Investment Corporation (5%), a Chinese sovereign fund. As of the end of 2017, the Silk Road Fund had invested 6 billion dollars in the BRI—80% of which in equity investment—including 1.65 billion in the Karot Hydropower project along the China-Pakistan Economic Corridor. Notably, the Silk Road Fund and the European Investment Fund signed a memo of understanding in 2017, each committing 250 million euro towards private equity and venture capital.

Two multilateral institutions—the Shanghai-based New Development Bank (ndb) and the Beijing-based Asian Infrastructure Investment Bank (aiib)—are also major financiers of BRI projects. The NDB was established in July 2014 by the five BRICS—Brazil, Russia, India, China and South Africa. The bank was seeded with 50 billion dollars, and the intention was to increase that to 100, to finance infrastructure projects.

The AIIB, a multilateral development bank, now has 87 approved members from around the world. Initially proposed by China, the AIIB began operations in January 2016—with a registered capital of 100 billion dollars. The bank provides sovereign- and non-sovereign-backed project financing. Pledging to be “lean, clean and green”, the AIIB has invested 5.34 billion so far in projects in Azerbaijan, Bangladesh, China, Egypt, Georgia, India, Indonesia, Myanmar, Oman, Pakistan, Tajikistan, the Philippines and Turkey. The AIIB teamed up with the World Bank in June 2017, for instance, providing 40% of a 380 million dollar loan to Andhra Pradesh in India to build a power plant.

The World Bank has given both verbal and monetary support to the BRI. In May 2017, the bank pledged 86.7 billion towards development and connectivity projects in BRI countries. In the words of the World Bank president Jim Young Kim: “The Belt and Road Initiative has potential to lower trade costs, increase competitiveness, improve infrastructure, and provide greater connectivity for Asia and its neighboring regions.”

The IMF has increasingly recognized China as a positive force on the global economic stage. In fact, China is the first emerging economy to have its currency included in the Special Drawing Rights Basket. Being in the SDR Basket boosts the credibility of the renminbi with international investors. In line with its currency’s internationalization, Beijing supports foreign governments, financial institutions and companies with good credit rating to issue renminbi bonds in China to help finance BRI projects.

Challenges Ahead

Reflecting China’s own experience and preferences, the BRI seems to represent a move away from standard development models that emphasize institutional reforms—often with accompanying conditionalities—towards a more investment-driven approach focusing on infrastructure, jobs creation and trade. Many have welcomed it, as evidenced by the long list of AIIB members and the intensely high-level international participation at the Belt and Road Forum in May 2017.

But the glass can be seen as half full or half empty. Implementation of the BRI is likely to entail risks. International investment in contemporary history is a field where China is a novice; as such, the learning curve will be steep and ensuing costs high. Indeed, cross-border infrastructure projects are some of the most difficult to implement, as they require complex and often long negotiations over proposed routes, development rights, financing and investment returns. BRI countries are in various states of development, and their regulatory frameworks vary, as do their levels of corruption. Some are politically unstable. Many remain unfamiliar to Chinese investors both linguistically, institutionally, culturally and religiously, which adds to misperception, misunderstanding and miscalculation.

Evidence also suggests that state-led or subsidy-driven investment, when pursued in a hot dash, tends to cause boom-bust cycles. China has managed to weather quite a few rounds in the past due to the unique features of its political economy. But it is not clear whether this will also work in different cross-national institutional settings, especially where state capacity is weak and tribalism looms large. Although it is too early to pronounce a final verdict, the risk is obvious; if not managed well, the entire initiative could boomerang to hurt China. The BRI is a work in progress: China needs to maintain vigilance in this early phase.

The biggest risk, however, is not economic but geopolitical. To many observers, implementation of the BRI will likely have an important effect on the regional economic architecture—patterns of infrastructure development, trade, investment, energy supplies, IT outlays, policy coordination and institutional setups. In turn, it will have geostrategic implications for China, the United States, and other major players, such as Japan, India and Russia. Having boycotted the AIIB, Washington increasingly sees the BRI as a threat to the liberal post-WWII system dominated by the US. Indeed, as a countermeasure against China, Trump has tried to upgrade the profile of the Quad—a partnership that includes the United States, Australia, India and Japan.

More notably, in its December 2017 “National Security Strategy”, the Trump administration explicitly identified China (together with Russia) as a near-power revisionist rival that poses the most significant long-term threat to America’s position in the world. Uncertainty is mounting as a trade war intensifies. At least one observer (Graham Allison, in 2017), has likened the battle brewing between China and the US to “Thucydides’s Trap”—a deadly pattern of structural stress that results when a rising power challenges a ruling one. Indeed, for China, the biggest challenge becomes how to manage such big-power relationships.

This article appeared originally in History is back, Aspenia international 82-83-84, May 2019. www.aspeninstitute.it

- “The Belt and Road Initiative” is the official English translation, according to a note issued in 2015 by the Chinese government. Previously, Yidai yilu changyi had been translated as “the One Belt One Road strategy (or project or program or agenda)”. Notably, by rejecting “strategy” and adopting “initiative”, the accent was put on cooperation: “strategy” connotes a unilateral foreign policy tool, whereas “initiative” suggests a proposal to work with other countries. The idea is to improve connectivity in Eurasia, with extensions to Africa and Latin America.

- In late 2014, the Chinese Communist Party established a BRI group to exercise oversight, and named as its leader Zhang Gaoli, a member of the seven-man Politburo Standing Committee, the highest de facto decision-making body in China.

- About 50 Chinese SOES have invested in 1,700 BRI projects since 2013, according to the spokesman of the Belt and Road International Forum in May 2017.