Over the past year, a trend towards higher energy and commodity prices has been emerging, and the Ukraine conflict – with its consequent international tensions – has only exacerbated that trend. While Covid-19 restrictions led to a decrease in electricity and gas consumption in 2020, the year 2021 registered a global turnaround: demand for electricity increased by 6%, corresponding in absolute terms to a record-breaking year-on-year increment of 1500 TWh (terawatt hours). Similarly, gas consumption grew by 5% in 2021. In large part due to the fast post-pandemic restart of the global economy, these increases were also caused by climate effects such as harsh winter weather conditions and the drought in Brazil.

Energy sources that provide electricity saw a particularly significant spike, and more than half of the additional demand in 2021 was provided by coal. The latter’s use increased by 9% with respect to 2020. Indeed, these dynamics led to an increase of 7% for CO2 emissions in the power sector, after two years of decline.

Power in Europe

This situation has had a notable impact in Europe, in two key sectors: gas and power. Natural gas plays a pivotal role in Europe’s power generation as the continent is progressively phasing out coal. For example, Italy aims to phase out its coal power plants entirely by 2025; indeed, some units have already been shut down and other players are developing plans for closures and conversions (e.g., replacing coal with renewable power plants). The rise in demand, satisfied by fossil fuels, coupled with energy supply constraints (prolonged maintenance of nuclear plants, unplanned outages and gas issues related to Russia) has resulted in an unavoidable increase in gas and electricity prices.

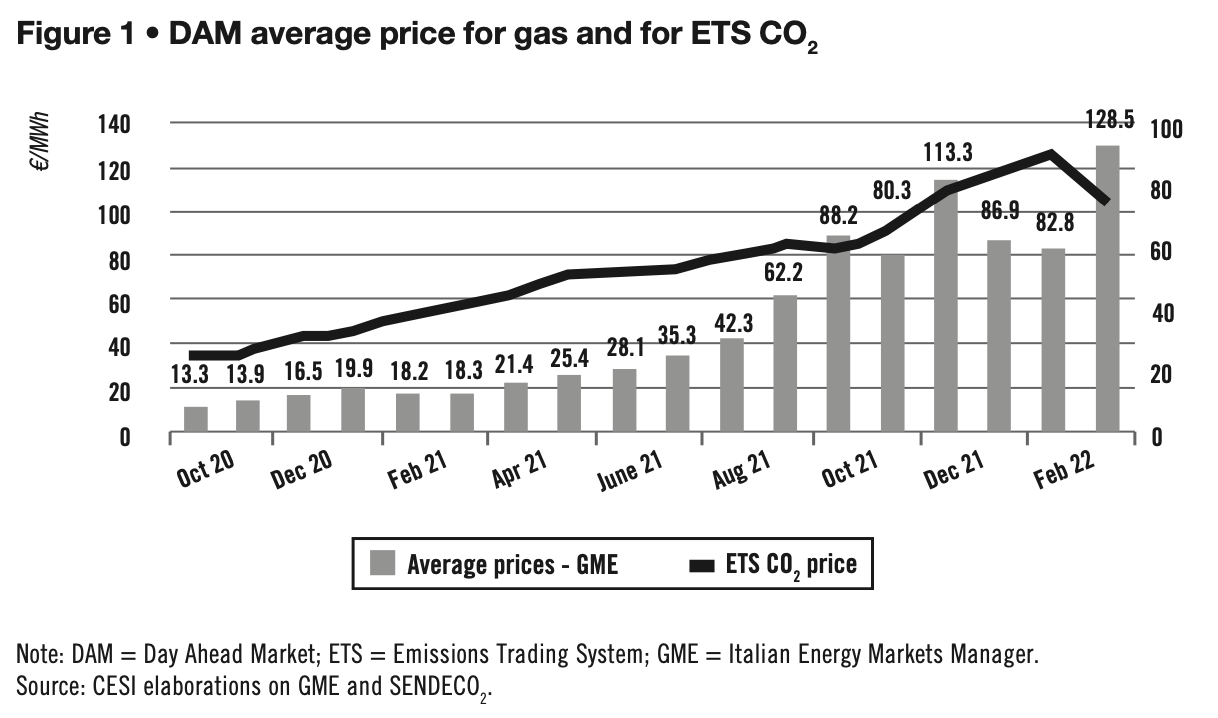

The upward trend of gas prices in Italy, like in much of Europe, had already started at the end of 2020 and reached its peak in March 2022, with the Ukraine conflict. Indeed, in March 2022, the average price of gas exceeded 128 €/MWh (euro per megawatt hour), showing an increase of 600% as compared to twelve months earlier. The spike in gas prices was mainly due to the risk perceived by Western European purchasers about a sudden interruption of gas flows from Russia.

Spot prices later stabilized at around 100 €/MWh in April, when it became clear that it is neither in the interest of Russia, nor in that of Ukraine to stop the gas flowing to the European Union. Along with soaring gas prices, the price of CO2 also rose dramatically. At an average of 90 €/t (euro per ton) in February 2022, CO2 allowances cost almost three times as much as in early 2021. To make things even worse, maintenance activities at several French nuclear power plants this year have caused a cut in their electricity production by approximately 30 TWh. The decrease in non-CO2 nuclear generation in France means, for Europe, more electricity generated by fossil fuel power plants, and thus a further increase in emissions.

The cost of the green transition

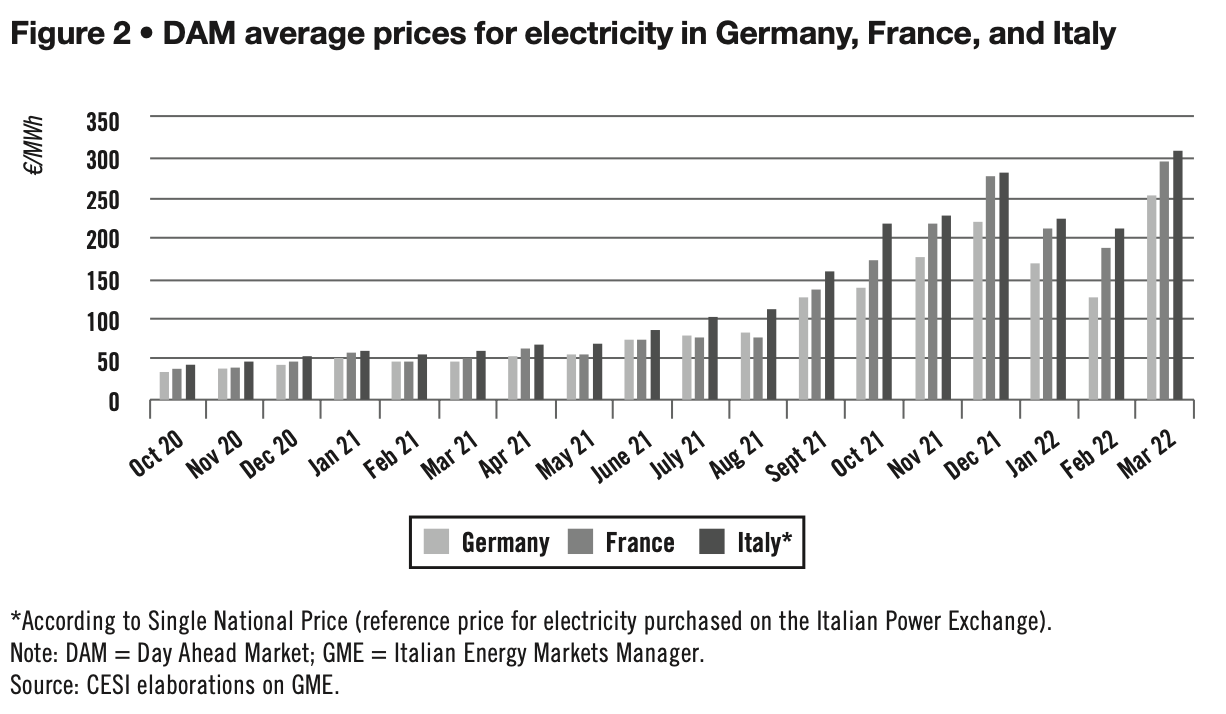

High fossil fuel prices have led to even higher electricity prices, which continue to break records in Europe. The average Day Ahead Market price in Italy in March 2022 peaked at over 300 €/MWh, five times its March 2021 value. The trend has been similar in Germany and France, but worse in Italy, where the generation fleet largely relies on gas.

In truth, all commodities saw a soaring trend in 2021. For example, coal doubled from 85 $/t to 170 $/t last year in Europe, and by March 2022 the increase had reached a record of approximately 420 $/t. Metals too – especially those used in green technologies – shot up in price. Nickel, for instance, used in batteries, reached an absolute record of 100,000 $/t in March 2022, before being suspended on the London Metal Exchange for a few days. Tin has more than doubled since the beginning of 2021, with values staying well above 40,000 $/t over the last few months. Similarly, copper – widely used in renewable and battery technologies – doubled in just one year to more than 10,000 $/t, after having reached its lowest value in five years in April 2020. The growing demand for electric vehicles and for batteries has caused lithium prices to rise by 550% in the last year.

This sharp upward trend in commodities and the consequent spiking energy prices are fueling inflation, which has a particularly adverse impact on economies with high public debt. As such, this phenomenon looks like what Europe already experienced during the oil crises of 1973 and 1979, but in the current situation the root causes are substantially different.

Similar problems, different reasons

The energy crises of 1973 and 1979 were triggered by specific events. In the first case, following the conflict between a coalition of Arab states led by Egypt and Syria against Israel (the Yom Kippur war), the Arab countries in OPEC decided to enact an oil embargo against countries supporting Israel. The effect was notable in Western Europe, which suffered a consequent sharp increase in oil prices.

In 1979, the crisis arose after the Iranian revolution, which caused a drop in Iran’s oil exports, with a subsequent rise in prices. Those two energy crises have a common point: namely, they are focused on a specific commodity – oil – as well as on local events.

The phenomenon which occurred in 2021 is different. The worldwide upward trend in commodity and energy prices was initially fueled by the quick post-pandemic economic recovery of demand, while production and supply chains failed to keep up. Alongside the problem of demand outpacing supply, the world is also suffering from the concentration of these scarce natural resources in a few key areas and countries. This issue does not only concern oil and gas. Russia is the third greatest global supplier of nickel, for example, and Norilsk is the largest producer in the world of nickel class 1, accounting for 20% of global supply. Other critical materials for the energy transition – such as lithium, cobalt, and rare earth elements – also depend almost entirely on specific geographic regions: the top three countries for each material provide more than 75% of the global supply.

The combination of these factors today calls for more complex and structured solutions based on a systemic approach to the problem.

The vulnerability of Europe

In the present context, Europe is particularly vulnerable because of its heavy reliance on the import of primary resources. Fossil fuel imports in the EU account for approximately 60% of gross energy consumption. This percentage has grown over the past few decades, due to the decline of production on European territory.

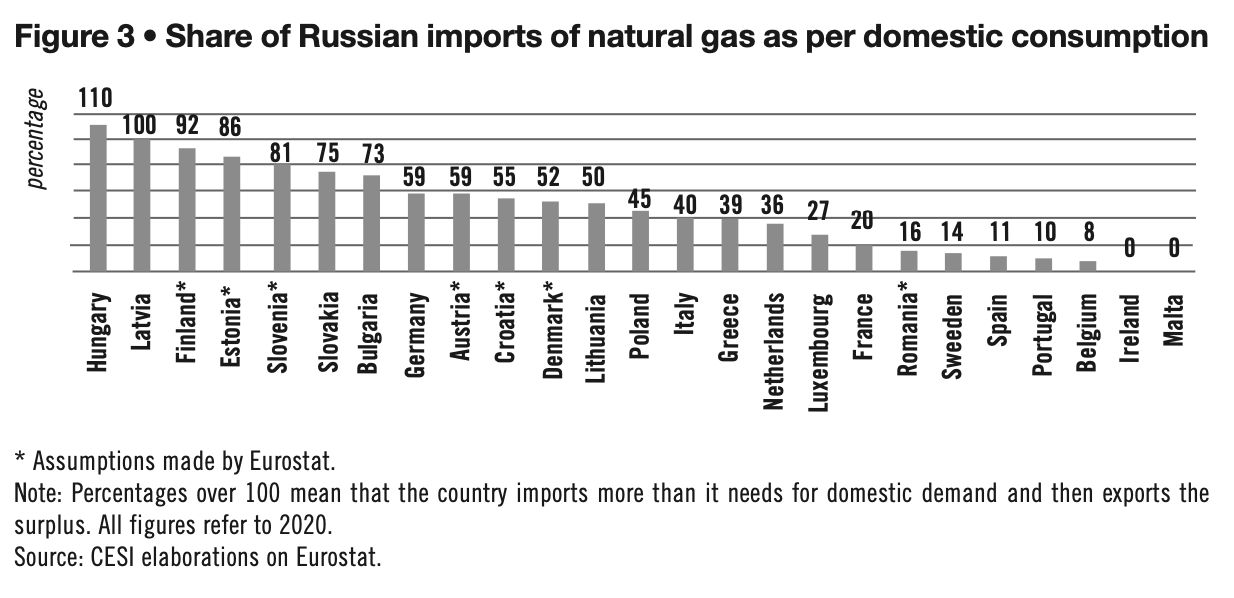

The crisis in Ukraine has further exacerbated the situation. This is not due so much to a real lack of gas, coal, and oil imports from Russia (at least at the time of writing), but rather to the indirect effects of sanctions and to the need to diversify primary resource supplies, for geopolitical and security reasons. A fast downturn or even a complete shutdown of energy imports from Russia would not be easy and would certainly be very costly for the EU economy, given its current dependency. Russia is the EU’s largest fossil fuels exporter, with a share of 45% for natural gas and coal and 27% for crude oil imports. Some member states are more dependent than others on the import of primary resources from Russia. Figure 3 shows how some European countries are almost completely reliant on Russian imports for natural gas – a key fuel in decarbonization efforts. Overall, in 2021, the EU imported as much as 155 bcm (billion cubic meters) from Russia. Those countries that are closest to Russia geographically are the ones that are more dependent on their gas supply, with 13 countries relying on their vast neighbor for more than half their overall need; in absolute value, however, the countries with the highest volumes of gas imported from Russia are Italy and Germany.

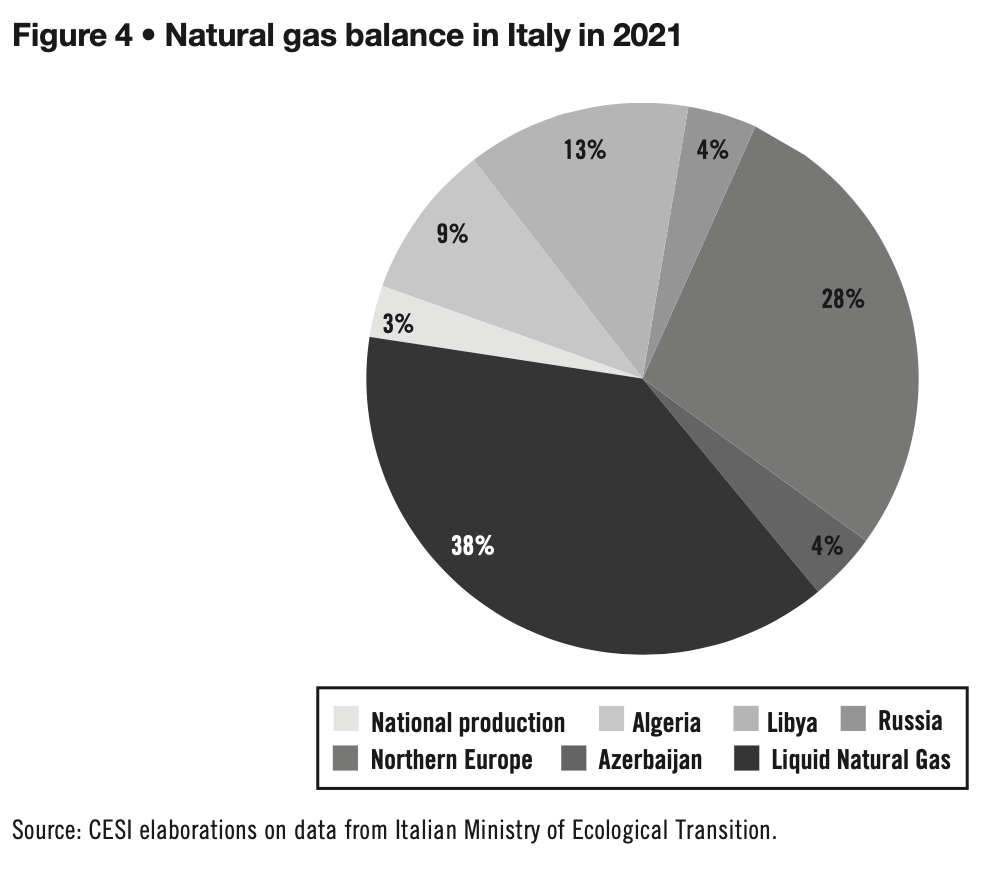

Indeed, the most recent data published by the Italian government confirms the country’s high reliance on Russian imports in 2021. Despite Italy’s location at the center of the Mediterranean (ideal for sourcing gas from North Africa, the Eastern Med or the Caspian), Russia is Italy’s largest single supplier. Last year, Italy imported 29 bcm of gas from Russia, which corresponds to almost 40% of internal demand.

How to make energy affordable, secure and sustainable

The EU is facing a triple challenge: 1) actions are needed to mitigate rising commodity and energy prices so as to avoid a slowdown of the promising economic recovery witnessed in 2021, which saw the EU GDP increase by 5.2%; 2) quick-start measures must be adopted to curb energy dependence from Russia in the short term and also, more permanently, over the medium term; 3) the long-term goal of zero net emissions by 2050 must be maintained.

Deviating from the decarbonization pattern adopted by the EU is not an option, at least for now.

Some objectives have already been set for 2030, such as -55% of greenhouse gas emissions (in comparison to 1990 levels), as proposed in the “Fit for 55” initiative launched in July 2021 by the European Commission. Therefore, spot initiatives such as the postponement of the phasing out of coal for power generation can only be tolerated in the short term. A delayed phase-out of coal would also trigger market mechanisms for CO2 allowances that push the EU Carbon Permit price up, with a consequent adverse impact both on electricity prices and on the competitiveness of manufacturing industries. Furthermore, high carbon emission prices could make coal less competitive than natural gas. This would push electricity prices up and also increase demand for natural gas, making it increasingly difficult to diversify imports away from Russia.

Hence, what can be done in the medium to long term to tackle the problem without endangering the decarbonization path?

Maximize imports from existing gas pipelines. Imports can increase from Algeria (about 9 bcm through Transmed) and from Azerbaijan (2 bcm through the Trans Adriatic Pipeline). The solution is not straightforward: imports from Algeria can only increase progressively over 2-3 years and would not solve Europe’s energy dependency. Furthermore, natural gas imports from Algeria are at risk, due to Algeria’s internal demand and to the depletion of some wells, which need further investment to boost extraction. Enhance liquefied natural gas imports. Theoretical EU capacity is 157 bcm, which could cover 40% of EU gas demand. The utilization of regasification terminals in 2021 was around 50%; therefore, maximizing the use of these infrastructures would make it possible to replace 75 bcm of natural gas, corresponding to approximately 50% of Russian imports. But this is only theoretical, as it would depend on three important factors: arbitrage with other markets, notably East Asia; bottlenecks in LNG carriers, the cost of which has always been quite volatile (recently, indeed, the daily rental cost skyrocketed to 250,000 dollars against an average of 77,000); limited liquefaction capacity in exporting countries. A large share of capacity is already contracted, and little liquidity is available on the secondary market.

Additional import routes can also cover a marginal share of demand for natural gas.The President of the United States promised up to 15 bcm of LNG exports to Europe, but this covers only 10% of Russia’s gas imports. Also, LNG is much more expensive than Russian gas: it costs 50% more, at least; when purchased on the spot market, it can cost up to five times more. Finally, there is a limited interconnection capacity in Europe between some areas – notably from Spain to France. This constrains the use of Spanish regasification capacity for export to other European countries. The expansion of LNG capacity – even resorting to the use of Floating Storage and Regasification Units – requires about 18-24 months from the granting of authorization; as such, it is not an immediate solution.

In consideration of all of the above, the estimation of a progressive LNG growth of 50 bcm (as suggested by RePowerEU) might be a more conservative/feasible figure.

Still, even this objective might not be attainable in just one year. Therefore, further actions are called for, notably:

Accelerated RES power plant deployment. Given the multiple constraints related to alternative natural gas supplies, one key solution lies in an accelerated RES (Renewable Energy Systems) Power Plant deployment. Besides cutting natural gas consumption, helping to curb soaring energy prices, and thus avoiding further vulnerabilities, this solution is in compliance with decarbonization targets. It can help reduce energy dependence.

At the beginning of April 2021, the German government formulated a proposal to attain 80% RES penetration by 2030 and 100% green power by 2035. If Germany’s parliament approves the proposal, plants providing an average of 10 GW (gigawatt) of wind and 22 GW of solar power will be installed, per year, from 2025 onward.

A similar initiative was launched in Italy by the association of the main power producers, Elettricità Futura. The target was for 60 GW of new RES power plants to be installed by 2025. The new RES power plants were meant to yield a theoretical savings of 15 bcm per year in natural gas. Realistically, due to market mechanisms and system constraints, savings were unlikely to exceed 10 bcm; nonetheless, this would represent more than one third of the current natural gas imports from Russia. Further analyses carried out by CESI showed that even a more moderate trend in new RES power plant installation – reaching 40 GW by 2025 – would still save a similar amount (9 bcm), and also mitigate the risk of RES generation curtailment, provided that at least 5.7 GW of storage facilities (electrochemical batteries) were also commissioned.

Market design. Currently, the Day Ahead Market across Europe is based on the System Marginal Price; consequently, all units selected in the clearing process are remunerated at the same price. Increasing the penetration of RES calls for the adoption of a dual price mechanism, to decouple the remuneration of CAPEX-based RES units from OPEX-based thermal power generation linked to commodity prices.¹ In this way, the overall energy disbursement of final users is reduced. Moreover, through appropriate market platforms, consumers could establish long-term bilateral power purchase agreements with RES producers, thereby granting stable prices over a sufficiently long period. On their side, RES producers are remunerated at a price covering CAPEX and OPEX costs, including financial capital costs. A reform process is clearly called for in this regard, to be undertaken by all EU member states. Behavioral changes and energy efficiency. Other measures – such as limiting the use of heating or cooling systems – could also lower the demand for gas in Europe. In the RePowerEU proposal, energy consumption estimates – perhaps optimistically – suggest that turning down the thermostat by 1°C in buildings would save as much as 10 bcm of gas per year. In addition, further energy efficiency measures (both at industrial and residential levels) promise to significantly lower the amount of energy consumed per unit of economic output.

Two specific areas demand attention in this regard. Firstly, it is necessary to have greater social acceptance of RES power plants and their related infrastructures, such as storage and network reinforcements. These are currently hindered by bureaucracy and by cumbersome authorization processes since residents do not want such assets close to their homes. Secondly, regional economic blocs should be concerned about supply chain dependence on foreign imports, especially when materials and technologies are concentrated in so few countries – countries belonging to competing geopolitical areas.

Key messages

Addressing the triple energy challenge – that is, mitigating energy prices (affordability), reducing energy dependence (security of supply), and keeping on track towards net zero greenhouse gas emissions (sustainability) – calls for the adoption of a number of measures.

Priority should be given to “quick-start actions”, relying on existing infrastructures, and to a fast reform process of market rules.

Nevertheless, over the medium to long term, the current energy crisis must spur us on our way to net zero emissions, leading to the quick commissioning of RES power plants, promoting further energy efficiency measures, improving energy transportation infrastructure, and investing in new technologies such as green hydrogen or next generation nuclear plants. This is how our countries can meet the triple energy challenge.

At the same time, we must avoid creating new vulnerabilities, such as excessive dependency on imports from a single supplier, both of commodities and of key technologies.

The bottom line is that today’s energy crisis is driving inflation and de-globalization. Policy-makers must turn this around. If decarbonization is to resist and to survive, we need to work harder than ever to make it happen.

- Capital expenditures (CAPEX) are a company’s major, long-term expenses (such as buildings, equipment, machinery, and vehicles), while operating expenses (OPEX) are a company’s day-to-day expenses.

This article appeared in Aspenia.it.

Aspenia international 95-96, “Money and power”, May 2022. www.aspeninstitute.it